Discretionary Mutual Funds Under Scrutiny: Independent Commentary Highlights Key Risks

A recently released industry report examines the growing discussion around discretionary mutual funds as an alternative to conventional insurance in Australia. While these funds offer a member-focused approach and potential cost savings, the commentary draws attention to several limitations—including weaker consumer protections, discretionary claims handling, and less regulatory oversight. The writers urge businesses and professionals considering this option to understand the differences and possible risks before making decisions. Readers are invited to explore the full analysis for a detailed perspective on how discretionary mutual funds compare to traditional insurance, and why caution is advised.

This is the full report on Discretionary Mutual Funds as provided by independent industry commentators.

ConsultRe Pty Ltd

ACN No 143 319 135

+61 2 8197 1529

Unit 24 Waterview Wharf

37 Nicholson St Balmain East

PO Box 173 Balmain NSW 2041

www.consultre.com.au

30 October 2025

Discretionary Mutual Funds

There is a lot of discussion in the Australian insurance market, particularly amongst insurance brokers, regarding the use of discretionary mutual funds as an alternative to traditional insurance.

A Discretionary Mutual Fund (DMF) is often created by a group of businesses, professionals, or individuals with similar risks. They share the goal of providing financial protection.

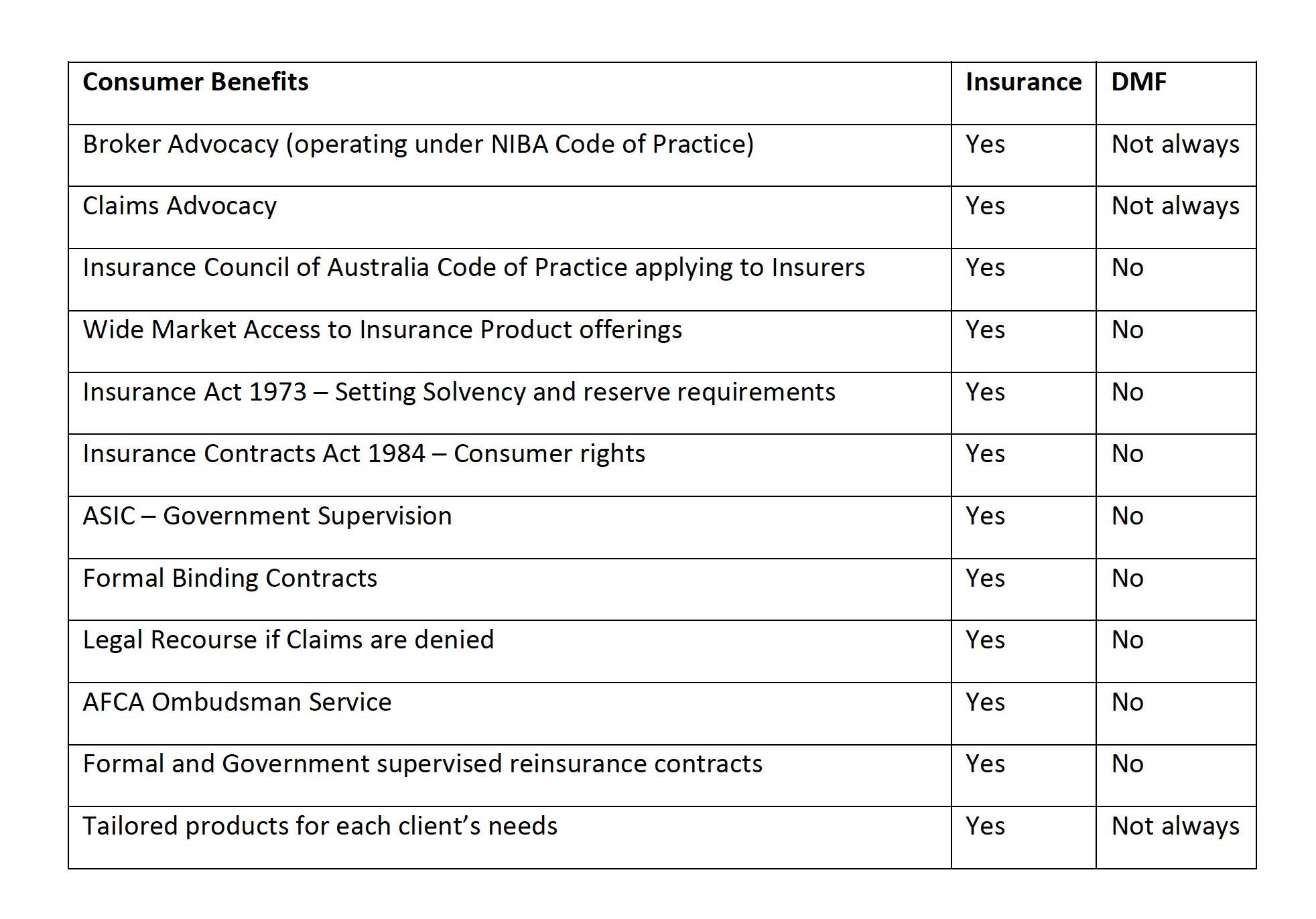

DMFs can offer advantages such as lower costs and a member-focused structure. There are however significant differences between a DMF and Insurance that create unique risks for members of a DMF compared to those with an insurance policy.

Some insurance brokers do not support DMFs due to the increased risk and their obligations to advise their clients professionally. Using an insurance broker helps the client compare policies from multiple insurers and get expert advice tailored to their needs. They also assist clients with their claims processing.

Most of the concerns raised by these brokers focus on a few key areas:

Contractual Right to a Loss Payment

The principal concern is that a DMF is not insurance. A traditional insurance policy is a legally binding contract. If a policyholder's claim meets all the terms and conditions outlined in the policy, the insurance company is legally obligated to pay the claim. If they fail to do so, the policyholder can pursue legal action to enforce the contract.

Members of a DMF do not have a contractual right to an indemnity. Instead, they have the right to have their claim considered by the fund's board of directors. The board then has the ultimate discretion to decide whether to pay a claim, how much to pay, or to decline it entirely. While the board has a fiduciary duty to act in the best interest of the members, there's no guarantee of a payout, even if the claim seems to meet all the stated conditions.

Regulation and Consumer Protection

Insurance companies are heavily regulated and are required to hold an adequate amount of capital to ensure they can pay claims, as supervised by the Australian Prudential Regulation Authority (APRA). They are also part of regulatory schemes that provide an added layer of protection for consumers and small businesses, often guaranteeing a payout even if the insurer becomes insolvent.

Insurers are required to have both an Internal Dispute Resolution (IDR) process and an External Dispute Resolution (EDR) process. This is achieved through membership of AFCA, the Industry Ombudsman service, which offers a free, legally binding service for consumers. This service mediates disputes with no cost to consumers.

DMFs are not required to comply with any of the Consumer Protection requirements that the government have implemented since the financial collapse of HIH. A DMF has no legally binding contract, so there is no way to dispute the DMF’s decision; it is final.

A Discretionary Mutual Fund (DMF) is not legally a contract of insurance; therefore, it avoids major insurance laws (Insurance Act 1973 and Insurance Contracts Act 1984), both of which provide key protection for consumers, including solvency and reinsurance requirements.

Financial Stability / Solvency

Insurance companies are subject to strict solvency regulations. This means they must hold sufficient capital reserves to meet their financial obligations, even in the event of significant losses. They must also meet APRA’s supervisory requirements for the purchase of their reinsurance program, which are heavily monitored. APRA monitors the insurers’ reserves and can require insurers to inject additional capital into these reserves to protect against failure.

Insurers also provide financial security information via external rating agencies (AM Best, Standard & Poors, Fitch etc), who audit the insurers and publish financial security ratings. These provide the public with a measure of transparency of their financial health and an additional means to monitor their financial security.

A DMF relies on the contributions of its members to create a pool of funds for paying claims. If the fund experiences a period of high claims or a catastrophic event, it may not have sufficient reserves to pay all claims. While many DMFs purchase "stop-loss" or other reinsurance programs to protect against significant losses, there's a risk that the fund could become underfunded, leading to only a partial payment or denial of claims.

The reinsurers that mutual funds decide to purchase from may also be from Foreign Unregulated providers, and in the event of failure of the fund, members would then need to seek redress from those reinsurers who no longer have any formal contract to meet members’ losses (and may not be in an Australian jurisdiction). The reinsurers may also fail, leaving the DMF with no recourse or funds for losses.

ConsultRe is a specialist consultancy comprising a team of highly qualified insurance and reinsurance professionals who have held executive positions with major international brokers, reinsurers, and insurers. Its services include reinsurance intermediary reviews, underwriting and claims audits, project management, arbitration/mediation, and key employee mentoring.

For more details visit www.consultre.com.au

Disclaimer: The information in this report is provided as a courtesy by GJIC Insurance for the general information of our clients and website visitors. The content was prepared by independent industry experts and is not personal financial or legal advice. GJIC Insurance does not guarantee the accuracy or completeness of the information and disclaims liability for any decision made based on this material. We strongly recommend seeking professional advice tailored to your circumstances before acting on any matters discussed in this report.